Introduction to Forex Major Pairs

Forex major pairs represent the most commonly traded currencies in the foreign exchange market, and they are crucial for traders looking to capitalize on global economic fluctuations. These pairs typically consist of the U.S. dollar (USD) combined with one or more other currencies, while the most notable examples include EUR/USD, GBP/USD, and USD/JPY. The prominence of these pairs is derived from their significant trading volumes, high liquidity, and the fact that they involve economies with substantial economic influence.

The EUR/USD pair, for instance, is known for its tight spreads and is often regarded as the benchmark for forex trading. Traders monitor economic indicators from both the Eurozone and the United States, as these can greatly impact exchange rates. Similarly, the GBP/USD pair showcases the relationship between the British pound and the U.S. dollar, highlighting economic and political developments within the UK and their effects on global markets.

On the other hand, USD/JPY is another major pair that attracts significant attention, particularly due to its relationship with interest rates set by the Federal Reserve and the Bank of Japan. These central banks’ monetary policy decisions can lead to volatile price movements. The behavior of these major pairs can vary during different market sessions, as European, North American, and Asian trading hours present unique opportunities and challenges for traders.

Understanding the characteristics of these forex major pairs is essential for anyone looking to engage in forex trading, as they set the foundation for assessing potential market movements. Their significance in global trading further underscores the need for traders to stay informed about economic factors that influence their performance.

Factors Influencing Upcoming Moves

In the forex market, numerous factors contribute to the fluctuations of major currency pairs. Understanding these elements is essential for traders aiming to anticipate potential price changes and capitalize on market movements. Economic indicators stand as one of the primary determinants, as they provide crucial information about a country’s financial health. Data such as gross domestic product (GDP), employment rates, inflation, and consumer confidence can significantly influence currency values. For instance, a better-than-expected employment report often leads to an appreciation of the national currency, as it implies a robust economy.

Geopolitical events also play a crucial role in shaping forex dynamics. Political stability or unrest can create uncertainty, leading traders to react swiftly to changing circumstances. For example, elections, trade disputes, or military conflicts can prompt volatility in the forex market, impacting investor sentiment and causing sharp movements in currency pairs. Traders must remain vigilant of global events and their potential repercussions on exchange rates.

Central bank policies are another significant factor influencing currency movements. The monetary policies set forth by central banks, such as interest rate adjustments and quantitative easing measures, directly affect the supply and demand for currency. A rise in interest rates typically attracts foreign investment, fostering an appreciation of the currency. Conversely, when a central bank adopts a more accommodative stance, the currency may weaken as a result of increased money supply.

Lastly, market sentiment can significantly impact forex trading. Traders’ perceptions and emotions about future market direction can create trends. If the market believes that a currency will strengthen due to favorable economic indicators or robust central bank action, this sentiment may lead to increased buying activity, consequently influencing currency movements. Therefore, a comprehensive analysis of economic indicators, geopolitical events, central bank policies, and market sentiment is vital for traders navigating upcoming changes in major forex pairs.

Market Predictions for Major Pairs

In the rapidly evolving landscape of the foreign exchange (forex) market, understanding expert opinions and market analyses is crucial for traders aiming to make informed decisions. Analysts from various financial institutions have been evaluating the macroeconomic indicators that influence the movements of major forex pairs, including EUR/USD, GBP/USD, and USD/JPY. Their predictions are shaped by a range of factors such as central bank policies, geopolitical developments, and fundamental economic data.

For instance, the EUR/USD pair is currently influenced by the European Central Bank’s (ECB) stance on interest rates, especially in light of recent inflationary pressures in the Eurozone. Many experts suggest that if the ECB maintains a hawkish approach to combating inflation, the euro may gain strength against the dollar. Conversely, a less aggressive posture could lead to a depreciation of the euro, presenting potential trading opportunities.

Similarly, for the GBP/USD pair, analysts are focusing on the UK’s economic recovery following recent tumultuous events. The Bank of England’s monetary policy decisions will play a pivotal role in shaping trends in this pair. Market sentiments are currently divided, with some traders speculating that the pound may strengthen as economic data improves, while others caution against potential setbacks due to uncertainties surrounding Brexit negotiations.

In the case of the USD/JPY pair, interest in U.S. Treasury yields and Japan’s monetary policies are key factors driving forecasts. Many analysts anticipate a gradual uptick in the dollar’s value against the yen if U.S. economic indicators continue to show strength. Technical analysis also supports this prediction, with various support and resistance levels providing traders with actionable strategies. Overall, these insights from financial analysts highlight anticipated trends and suggest that careful monitoring of economic indicators will be vital for navigating upcoming moves in major forex pairs.

Conclusion and Recommendations

As we conclude our analysis of the upcoming moves in major forex pairs, it is imperative for traders to distill the essential takeaways from our discussions. We have examined the intricate dynamics that govern forex market movements, particularly in light of pivotal economic indicators and geopolitical developments. Understanding these factors allows traders to make informed decisions that can significantly enhance their trading performance.

Traders should be particularly attuned to the influence of key economic reports such as employment figures, inflation rates, and central bank announcements. These reports can precipitate volatility in major currency pairs. Being proactive by staying updated with the economic calendar can provide traders with a significant advantage, enabling them to anticipate market reactions more effectively.

Risk management remains a cornerstone of successful forex trading. The methodologies we discussed underline the importance of setting appropriate stop-loss and take-profit orders based on market analysis. Additionally, diversifying positions across various pairs can mitigate potential losses and enhance overall portfolio resilience.

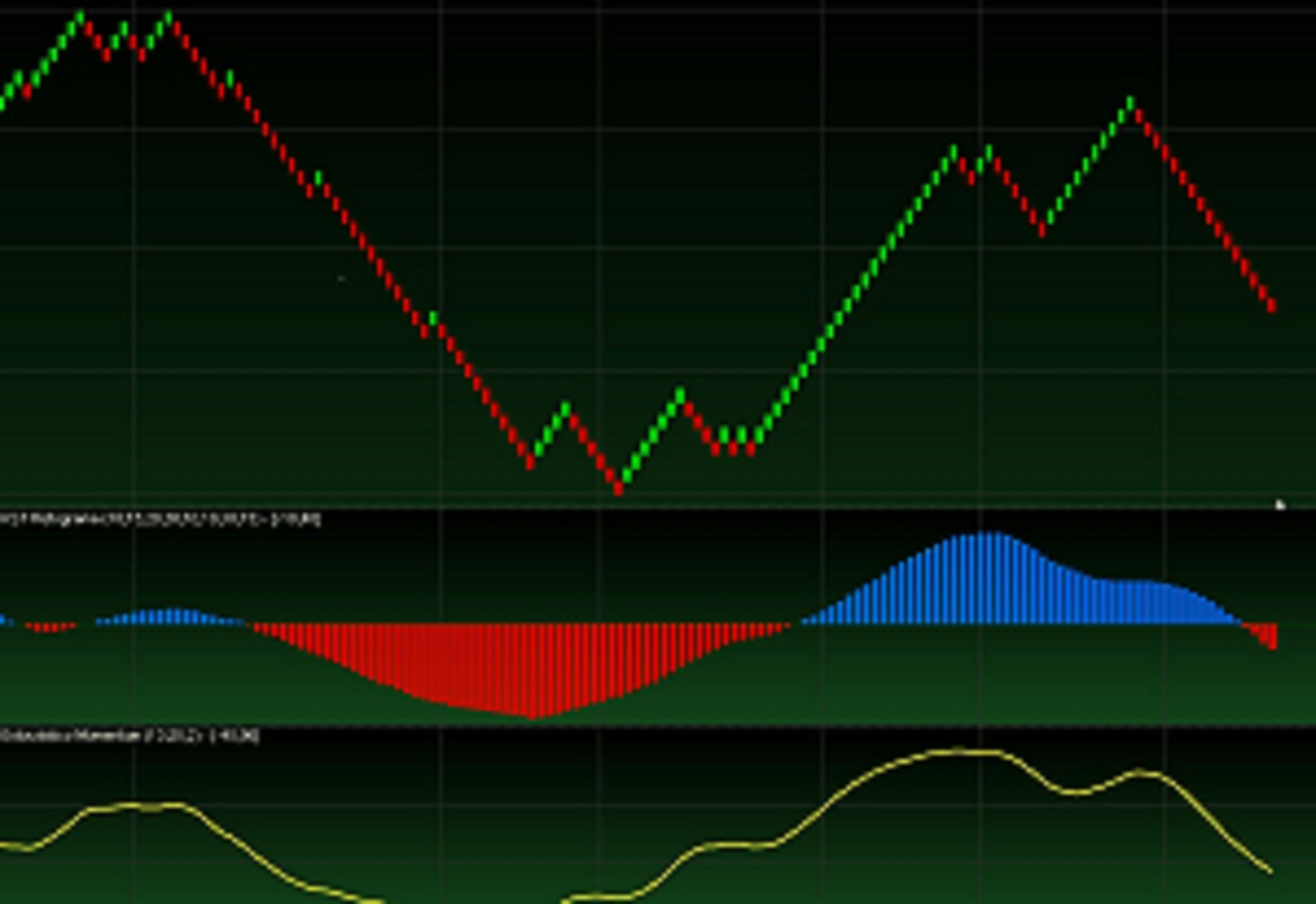

In navigating the fluctuations in forex pairs, it is also advisable for traders to formulate a robust trading strategy that incorporates both technical and fundamental analysis. Utilizing tools such as trend indicators and support-resistance levels can aid in making calculated entries and exits. Furthermore, applying a disciplined approach while avoiding emotional trading is vital for long-term profitability.

In light of the information presented, traders are encouraged to assess their strategies continuously and adapt to the evolving market landscape. By leveraging knowledge of major currency pairs and understanding the impact of global events, traders can position themselves to maximize opportunities while minimizing risks. Ultimately, informed trading decisions grounded in diligent research and analysis are key to success in the forex market.