Understanding Forex Market Dynamics

The forex market operates as a decentralized global marketplace where currencies are traded against one another. Understanding the dynamics of this market requires insight into the various components that influence currency exchange rates. Primarily, the value of a currency is driven by supply and demand, which can be affected by multiple factors including economic indicators, geopolitical events, and overall market sentiment. Economic indicators, such as GDP growth rates, inflation rates, and employment data, play a pivotal role in assessing a country’s economic performance and thus inform predictions about where a currency’s value may be headed.

Key players in the forex market include central banks, commercial banks, institutional investors, and retail traders. Central banks, in particular, have a significant influence as they can implement monetary policies that affect interest rates, which in turn impact currency values. For instance, if a central bank raises interest rates, foreign capital may flow into that country in search of higher returns, leading to an increased demand for the currency. On the other hand, if a country experiences political instability or economic turmoil, traders may lose confidence, resulting in a decrease in demand for its currency.

Market sentiment also plays an essential role in forex trading dynamics. Traders often react to perceived risks, making decisions based on psychological factors alongside fundamental data. News events, announcements, and reports can shift market sentiment abruptly; therefore, traders must stay informed about current events and updates. Economic calendars and news feeds provide vital information that traders can use to gauge potential currency fluctuations. In essence, a deep understanding of these market dynamics is crucial for professionals and newcomers alike, as they navigate the complexities of forex trading in an ever-evolving global landscape.

Recent News Trends Impacting Forex

The forex market is highly susceptible to external factors, with recent news trends significantly influencing currency valuations. Economic reports, particularly those related to employment, inflation, and GDP growth, provide crucial insights into the health of various economies. For instance, the release of the Non-Farm Payroll report in the United States often leads to immediate fluctuations in the USD, as traders adjust their positions based on perceived strength or weakness in the labor market. Similarly, inflation indicators such as the Consumer Price Index (CPI) can prompt adjustments to monetary policy expectations, thereby impacting forex trading strategies.

Central bank announcements also play a critical role in shaping forex market dynamics. Decisions regarding interest rates, quantitative easing, or currency interventions can lead to increased volatility. For example, when the Federal Reserve announces changes in interest rates or signals future monetary policy directions, it can result in sharp movements in currency pairs like EUR/USD or GBP/USD. Investors closely monitor these announcements, as they often provide guidance on the economic outlook and potential rate changes that could affect forex trading strategies.

Additionally, unexpected international incidents, ranging from geopolitical tensions to natural disasters, can create ripple effects across the forex market. A sudden conflict in a region can lead to a flight to safety, boosting currencies like the USD or JPY, while negatively impacting those of countries involved in the incident. Similarly, trade disputes can lead to currency depreciation or appreciation, emphasizing the necessity for traders to stay informed about global events. The interplay of these news items highlights the need for forex traders to remain agile, adjusting their strategies in response to evolving news narratives that affect currency values both in the short and long term.

Analyzing Currency Pair Movements Post-News

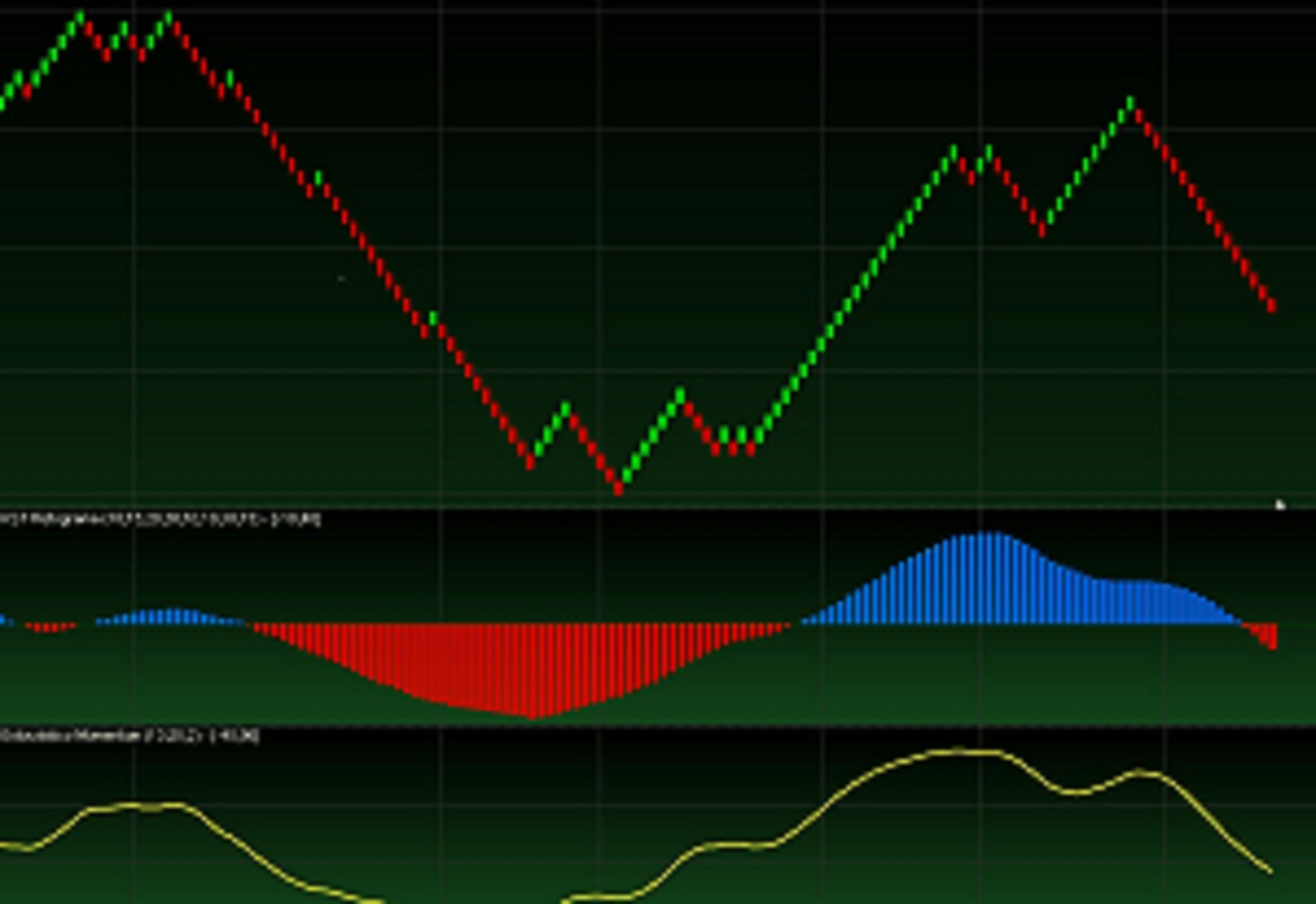

In the dynamic forex market, currency pairs often exhibit pronounced movements following major news events. This section delves into several case studies of selected currency pairs that reacted significantly to recent news releases, thus providing traders with valuable insights to inform their future trading strategies.

One prime example is the EUR/USD currency pair, which witnessed heightened volatility after the European Central Bank (ECB) announced its interest rate decision. Prior to the news release, the pair traded within a relatively stable range. However, upon the announcement, the exchange rate surged by over 150 pips, demonstrating a clear correlation between the ECB’s rate policy and market sentiment. A post-news analysis indicated that traders’ reactions were largely influenced by perceived economic conditions in the Eurozone, leading to bullish sentiment reflected in the price action.

Another noteworthy case involves the GBP/JPY pair following a significant employment report from the United Kingdom. Initially, the pair hovered close to its support level, but as the report revealed stronger-than-expected employment figures, it quickly climbed, subsequently breaking through its resistance zone. The surge was substantiated by comprehensive trading volumes, indicating that market participants reacted swiftly to the positive news. Analyzing price charts from this event illustrates a strong bullish trend, underpinning the importance of key economic indicators in shaping trader behavior.

Moreover, the USD/CAD pair presented an interesting case during recent oil price fluctuations catalyzed by geopolitical tensions. As oil prices, a critical factor influencing the Canadian economy, spiked, the CAD strengthened against the USD, which could be seen in the sharp downward movement of the USD/CAD pair. This interaction between global commodities and currency values underscores the intricate relationships that forex traders must navigate. Charting these movements allows for a deeper understanding of the potential impacts of news events on currency valuations, ultimately equipping traders to anticipate future market shifts more effectively.

Strategies for Trading Based on News Insights

In the dynamic world of forex trading, leveraging news insights can significantly enhance decision-making and improve trading outcomes. Traders can adopt several strategies to navigate the market effectively based on current events and economic announcements. One of the primary techniques is news trading, which involves entering positions just before or immediately after a relevant news release. Traders should pay close attention to important economic indicators, such as employment data, Gross Domestic Product (GDP) reports, and central bank announcements, as these can substantially influence currency valuations.

Another essential aspect of trading based on news insights is the placement of stop-loss and take-profit orders. Given the volatility that often follows news releases, it is prudent to set stop-loss orders at strategic levels to limit potential losses. A common approach is to place stop-loss orders slightly beyond recent support or resistance levels, ensuring they remain effective even during sudden market movements. Similarly, take-profit levels should be calculated based on realistic targets, often setting them at a distance proportional to the anticipated market volatility post-news release.

Effective risk management is crucial in such scenarios. Traders ought to limit their exposure by allocating only a small portion of their capital to each trade, typically recommended at one to two percent of the overall account balance. This approach allows for sustained trading in turbulent market conditions without risking significant capital loss. Staying updated with real-time news and utilizing reliable market analysis tools is equally important. Subscribing to news alerts, following economic calendars, and employing news apps can provide timely information crucial for making informed trading decisions. Combining these strategies can empower traders to navigate forex markets confidently, effectively maximizing their opportunities amid the chaos that often accompanies news-driven events.