The Comex silver market kicked off the week with a notable jump in delivery intentions, hinting at a real uptick in physical demand. As of November 4, a surprisingly high number of contracts are standing for delivery—an early sign that more players want the actual metal in their hands, not just a paper position. It’s a subtle but telling shift among both commercial buyers and investors who are deciding not to just roll their contracts forward this month.

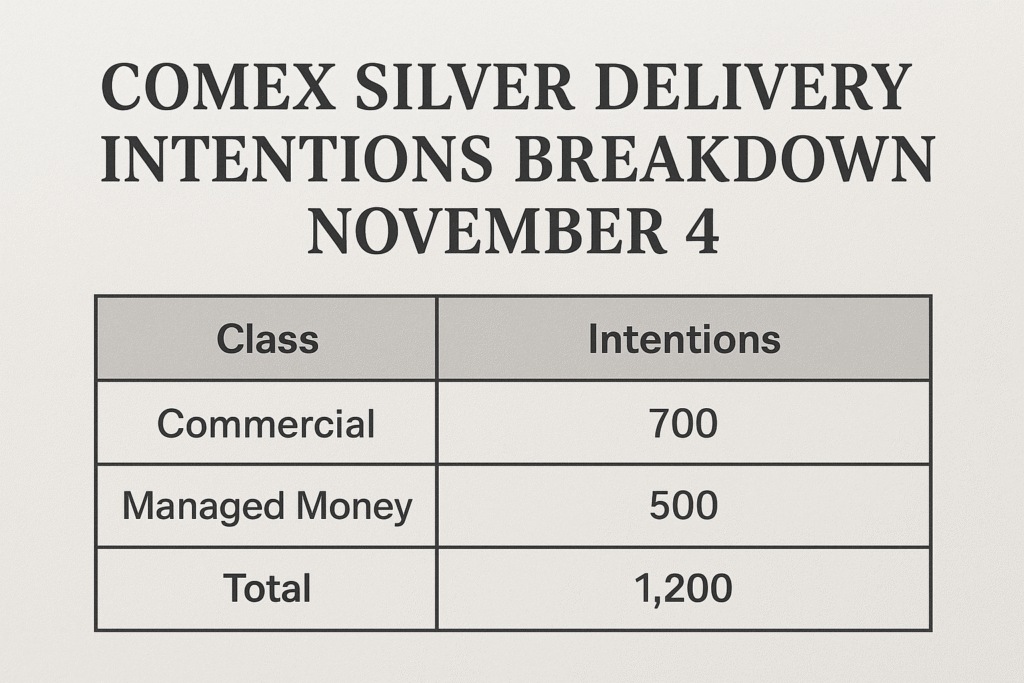

According to preliminary clearing reports, silver delivery intentions totaled approximately 1,200 contracts, equivalent to six million ounces of the precious metal. This marks a modest rise from the previous session, underscoring the ongoing tug-of-war between speculative traders and industrial consumers. The increased volume comes as silver prices hover around $26.10 per ounce, supported by a weaker dRecent preliminary clearing reports reveal a significant uptick in silver delivery intentions, totaling approximately 1,200 contracts, or six million ounces of this valuable precious metal. This increase not only reflects a growing enthusiasm among traders but also underscores the intense competition between speculative investors and industrial consumers.

As silver prices stabilize around $26.10 per ounce, the market is further supported by a weaker dollar and promising projections for sustained demand in manufacturing. This dynamic environment presents a compelling opportunity for those looking to engage with silver, signaling a robust prospect for future growth. Don’t miss out on the potential that lies ahead! dollar and expectations of steady demand in manufacturing in the months ahead.

Market watchers say the breakdown of delivery notices tells a story: the big commercial players—refiners, manufacturers, bullion banks—are still taking delivery, while hedge funds and other managed money types are playing it safe and tweaking their exposure based on the latest economic headlines. So, even though speculators are on the sidelines, demand from people who actually use or invest in silver seems to be holding up well.

The broader context for silver is also shifting. Industrial demand, driven by the clean energy sector, continues to strengthen, particularly in solar panel production and electronics manufacturing. At the same time, geopolitical uncertainty and inflation hedging have kept precious metals on investors’ radar, even as global bond yields edge higher.

Traders are watching closely to see whether the latest delivery data will translate into tighter near-term supply. With the December futures contract approaching its first notice day, any sustained increase in delivery intentions could reinforce bullish sentiment, especially if warehouse inventories begin to show a drawdown.

In the near term, technical analysts near $25.60. A break above resistance could invite further momentum buying, although much will depend on U.S. economic data releases and the Federal Reserve’s commentary this week.

Overall, the November 4 Comex silver delivery report highlights a steady undercurrent of physical demand and cautious optimism—signs that the white metal may be preparing for renewed strength as the year draws to a close.