Market Overview

The forex market has exhibited significant movement and volatility over the past week, particularly among major currency pairs, reflecting the ongoing influences of various economic indicators and geopolitical events. Central to this week’s market dynamics was the announcement of interest rate adjustments by several central banks, which has invariably affected currency valuations. The US dollar, for instance, has faced pressure due to mixed economic reports, while the Euro has gained traction as market participants react to the European Central Bank’s stance on inflation targeting.

In tandem with interest rate changes, inflation reports have emerged as crucial metrics, significantly shaping trading decisions. Recent data indicated a rise in inflation within the Eurozone, prompting speculation about potential monetary policy tightening. Conversely, inflation figures in the UK revealed a slight decrease, leading to a more cautious outlook for the British pound. Consequently, pairs such as EUR/USD and GBP/USD have displayed notable fluctuations, reflecting investor sentiment in response to these economic indicators.

Furthermore, geopolitical events, including tensions in various regions and evolving trade dynamics, have added layers of complexity to forex trading this week. The ongoing situation in eastern Europe has spurred safe-haven demand for currencies like the Swiss franc and Japanese yen. Traders appear to be adopting a wait-and-see approach, closely monitoring developments that could influence market stability. Overall, sentiment within the forex community remains cautiously optimistic, with traders anticipating potential opportunities as global economic landscapes evolve.

With these factors in mind, traders can better understand the currents flowing through the forex market, setting the stage for insightful predictions in the upcoming week.

Technical Analysis of Key Currency Pairs

In the realm of foreign exchange trading, technical analysis serves as a crucial tool for traders seeking to predict price movements in currency pairs such as EUR/USD, USD/JPY, and GBP/USD. By examining historical price data, traders can identify trends and establish potential support and resistance levels that may guide their trading strategies in the coming week.

Starting with the EUR/USD pair, recent price action indicates a consolidation phase. The current support level stands at 1.0800, while resistance can be identified around 1.0900. Indicators such as the Relative Strength Index (RSI) suggest that the pair is neither overbought nor oversold, implying that traders should remain vigilant for any breakout above or below these levels. Moving averages indicate a potential upward momentum if the price successfully breaches the resistance.

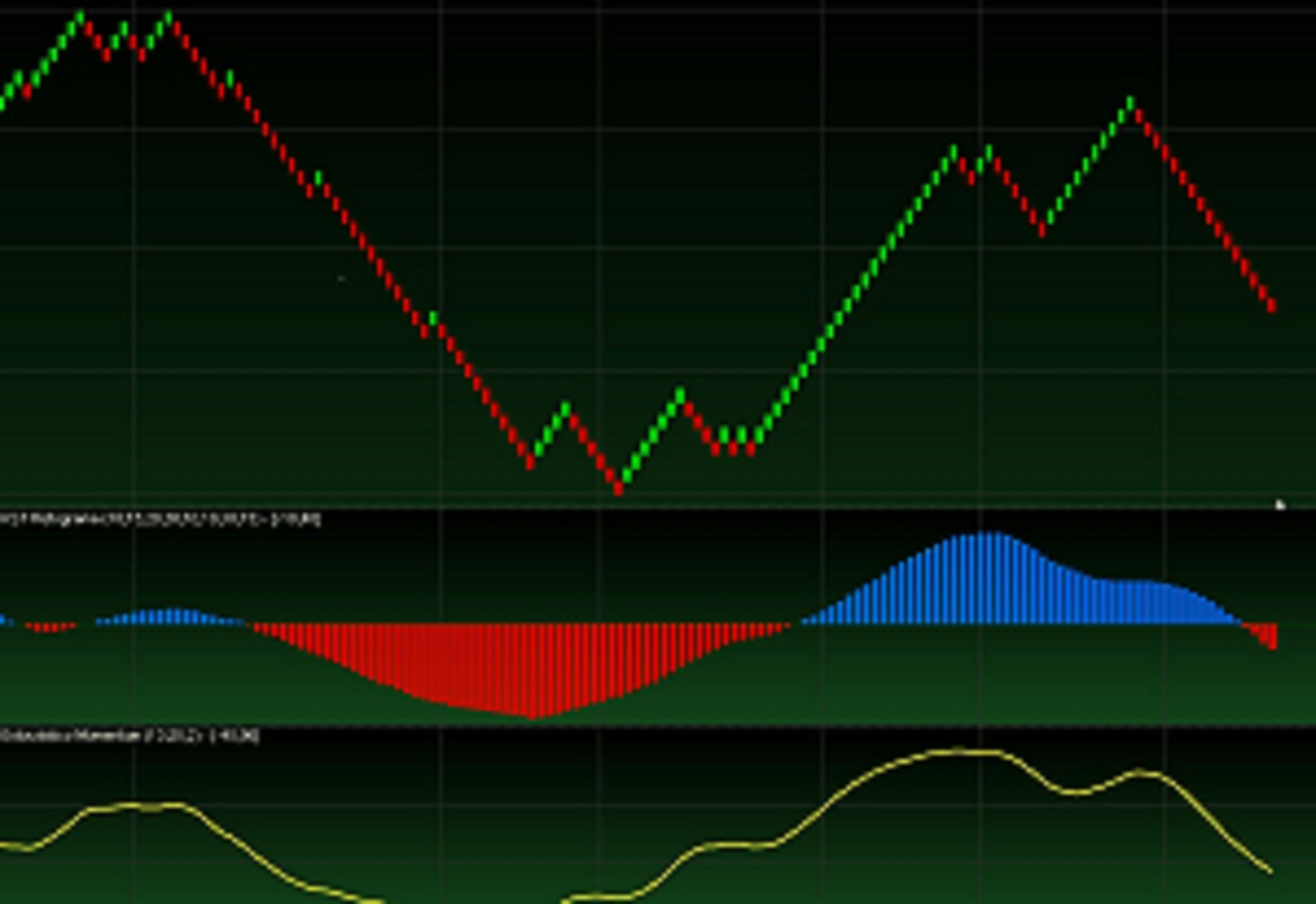

Turning to USD/JPY, this pair has shown notable volatility, particularly influenced by recent economic reports. The support level is apparent at 145.00, whereas resistance has been established around 147.00. The MACD indicator has been fluctuating, hinting at indecision in the market. Traders should closely watch for a decisive break through either level, which could signify a trend reversal or continuation.

Lastly, analyzing GBP/USD, we observe a bearish trend, with current price action hovering around 1.2400. Key support is identified at 1.2300, while resistance is calculated at 1.2500. The Fibonacci retracement tool suggests that the pair may be retesting the 61.8% level, a critical juncture for potential rebounds or downward moves. Traders may want to consider these technical indicators as they develop their strategies for the upcoming week.

Consolidating insights from these key currency pairs can provide traders with a comprehensive understanding of potential market movements and opportunities based on current technical analysis. Staying informed about these indicators will be essential for making informed trading decisions in the days ahead.

Fundamental Factors Influencing Forex Markets

The forex market is significantly influenced by various fundamental factors that shape currency valuation and trading decisions. Key among these are economic releases, central bank meetings, and political events. Economic indicators such as Gross Domestic Product (GDP), employment figures, inflation rates, and consumer confidence indices provide insights into a country’s economic health. Traders closely monitor the release dates of these indicators, as they often lead to increased volatility and can cause substantial currency fluctuations. A stronger-than-expected economic report may boost a currency’s value, while disappointing data can lead to sell-offs.

Central bank meetings and subsequent monetary policy announcements are another critical fundamental factor that drives forex market dynamics. Central banks control interest rates, which sway investor sentiment and influence capital flows. For instance, an increase in interest rates typically attracts foreign capital, leading to appreciation of that currency. Conversely, rates cuts often exert downward pressure. Market participants scrutinize central bank statements for cues regarding future monetary policy direction, as these signals can affect market psychology and trader behavior.

Additionally, political events, including elections, referendums, and geopolitical tensions, can create uncertainty in the forex market. Such events may disrupt the trading landscape, induce risk aversion, and cause traders to re-evaluate their positions. Furthermore, trader sentiment plays a crucial role in determining market movements. If traders are optimistic about a currency due to favorable economic data, it can lead to stronger demand and subsequent appreciation. Likewise, negative sentiment stemming from unstable political climates can destabilize currency values.

In conclusion, understanding these fundamental factors is vital for forex traders. Staying informed about economic releases, central bank meetings, and significant political happenings enables traders to make informed decisions in an ever-changing market landscape.

Predictions and Recommendations for Traders

As traders look ahead to the upcoming week, understanding the market’s potential movements becomes paramount for making informed decisions. Based on our thorough analysis of global economic indicators and current market trends, a few key predictions can be highlighted. The strength of the US dollar has shown resilience, with potential upward momentum as the Federal Reserve hints at a possible interest rate increase. Traders should closely monitor the upcoming economic data releases from the United States, as positive figures could bolster this trend, leading to a favorable environment for long positions on the dollar against other major currencies.

Conversely, uncertainties surrounding geopolitical tensions and fluctuating commodity prices could cause volatility in currency pairs. The euro, for instance, may face downward pressure depending on the performance of the European Central Bank’s policy decisions and inflation data. A worst-case scenario could involve a sharp decline if economic indicators fail to meet expectations, advising traders to adopt caution while considering positions involving the euro.

Regarding practical strategies, traders are encouraged to implement risk management techniques, such as setting stop-loss orders to mitigate potential losses. In addition, utilizing technical analysis to identify key support and resistance levels will help traders make timely decisions. For those focusing on currency movements, maintaining a diversified portfolio will cushion against unexpected market shifts. Overall, the combination of market analysis and informed trading strategies significantly enhances the probability of success in the rapidly evolving forex environment.

In conclusion, while predictions provide a valuable framework, traders must remain adaptable to the ever-changing market conditions. Staying informed and prepared will empower them to navigate the complexities of the forex market with greater confidence.